Data Center Cooling Market Size, Share, & Industry Analysis Report

By Product (Air Conditioners, Precision Air Conditioners), By Size, By Cooling Technique, By Service Type, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5867

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

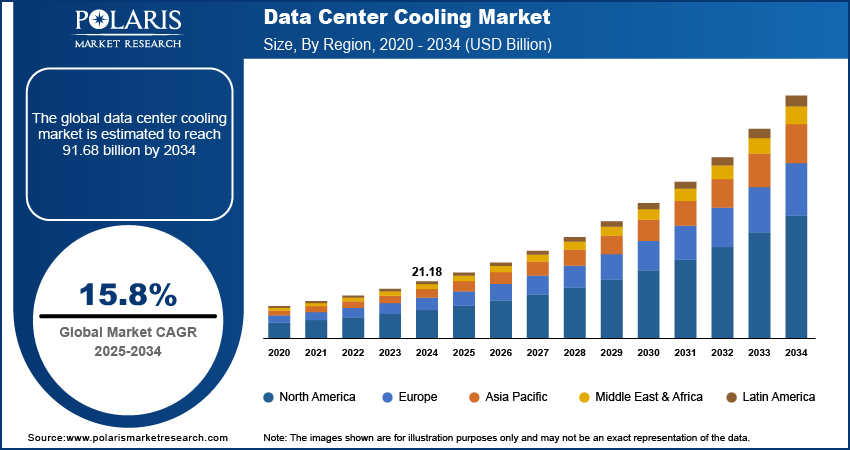

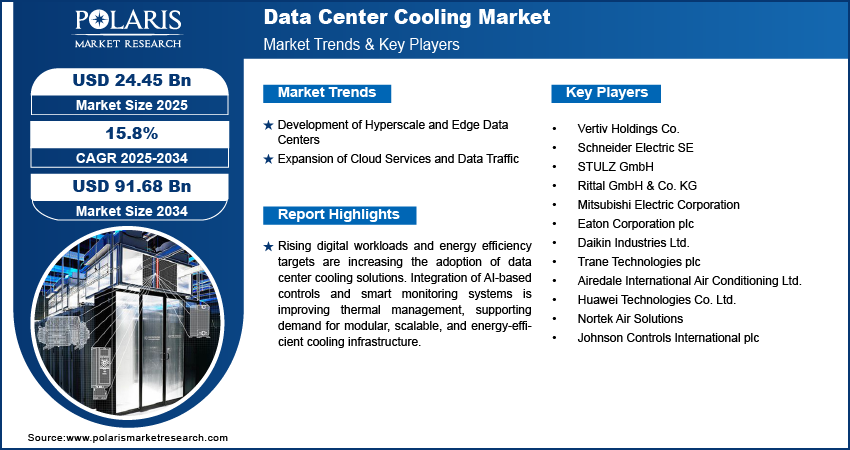

The global data center cooling market size was valued at USD 21.18 billion in 2024, growing at a CAGR of 15.8% during 2025–2034. Rapidly growing data traffic and cloud service expansion is driving the demand for the data center cooling.

Data center cooling systems help manage heat generated by servers and equipment, ensuring consistent performance and reducing energy waste. These systems include air-based and liquid-based technologies that support both traditional and modular infrastructure. The focus on reducing power usage effectiveness (PUE) and meeting energy efficiency standards is encouraging operators to adopt precision cooling solutions. Data centers across banking, telecommunications, and technology sectors are integrating energy-efficient cooling systems to support continuous operations. Compact system design, reduced water usage, and remote monitoring capabilities are helping operators improve cooling performance in both new and retrofitted facilities.

The adoption of data center cooling is also driven by regulations focused on environmental impact and sustainability. Efficient cooling helps lower electricity consumption, reduce carbon emissions, and extend equipment life. Developments in direct-to-chip liquid cooling, immersion cooling, and AI-based thermal management are expected to support long-term industry growth. These technologies are helping operators achieve better thermal control, reduce operational costs to meet global efficiency targets.

To Understand More About this Research: Request a Free Sample Report

Rising demand for energy-efficient infrastructure and growing complexity in IT workloads are pushing the adoption of advanced data center cooling systems. For instance, in July 2024, researchers at the University of Missouri-Columbia are developing an advanced two-phase cooling system that uses phase change to dissipate heat efficiently, potentially reducing energy use in data centers amid growing Artificial Intelligence computing demands. Global data centers are upgrading their thermal management strategies to meet environmental regulations and performance requirements. Regulatory frameworks and corporate sustainability goals are driving operators to lower carbon emissions and reduce energy consumption. Efficient cooling techniques help to maintain ideal operating temperatures, reduce energy waste, and support high-density computing environments. These systems improve overall data center performance by enhancing airflow, lowering power usage, and ensuring equipment stability under heavy loads.

Urban and high-growth digital regions are seeing steady demand for next-generation cooling solutions due to rising investments in hyperscale facilities, edge data centers, and cloud computing infrastructure. Advanced cooling systems offer space efficiency, low water usage, and reduced maintenance needs that comply with evolving design and operational standards. Operators prefer these solutions for their reliability, adaptability, and long-term cost benefits. Public and private investments in green data centers and smart thermal management support the integration of these technologies. As data processing needs expand, advanced cooling systems are becoming essential for building sustainable and future-ready digital infrastructure.

Industry Dynamics

Expansion of Cloud Services and Data Traffic

Rising adoption of cloud platforms and online services is increasing the number of data centers across key regions. Businesses are expanding digital operations, which led to higher demand for continuous data processing and storage. Cloud-based software, e-commerce, video platforms, and enterprise applications are generating large data volumes that require stable and secure infrastructure. According to the Cybersecurity Ventures, global data storage is projected to surpass 200 zettabytes by 2025, this includes data across private and public IT systems, utility infrastructures, cloud data centers, personal devices such as PCs, laptops, tablets, and smartphones, as well as IoT devices. These conditions raise the need for efficient thermal control to prevent hardware stress and maintain system reliability in high-load environments.

Higher processing activity leads to greater heat output from computing equipment. Cooling systems are essential to maintain safe operating temperatures and reduce the risk of hardware failure. Consistent thermal management improves uptime, extends equipment life, and supports performance under constant workloads. Operators are investing in advanced cooling technologies that help maintain system stability while reducing energy use. As data usage continues to grow, thermal efficiency remains a priority in data center planning and operation.

Development of Hyperscale and Edge Data Centers

Deployment of hyperscale and edge data centers across key regions is increasing due to growing digital activity and demand for low-latency services. Hyperscale data center facilities are designed to manage large-scale computing and storage needs, while edge centers focus on delivering localized data processing closer to end-users. For instance, in February 2025, CtrlS Datacenters announced construction of a new hyperscale data center in Chennai with a planned capacity of 72 MW. The facility aims to support growing digital infrastructure needs with enhanced scalability and efficiency. These facilities require reliable thermal systems to maintain equipment stability and avoid performance disruption under varying operational conditions. Construction in diverse environments and rapid deployment timelines are encouraging the use of modular and adaptable cooling solutions.

Edge data centers often operate in space-limited locations, requiring compact cooling units that support energy efficiency. Hyperscale centers contain dense hardware that generates significant heat, making high-capacity cooling systems necessary for long-term reliability. Efficient thermal control supports continuous operations and reduces maintenance risks. Scalable and remote-managed systems are being integrated to handle increasing computing volumes while optimizing energy use. Expansion of digital infrastructure continues to drive demand for advanced cooling technologies that align with the operational needs of modern data centers.

Segmental Insights

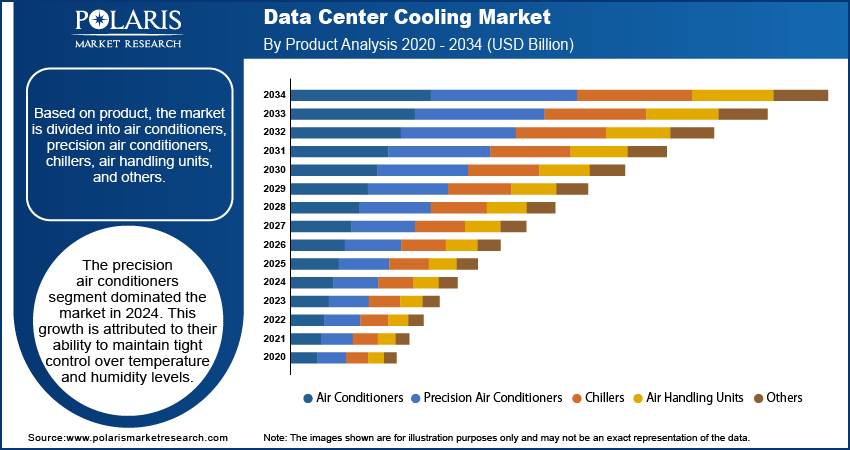

Product Analysis

The global segmentation, based on product includes, air conditioners, precision air conditioners, chillers, air handling units, and others. The precision air conditioners segment dominated the market in 2024. This growth is attributed to their ability to maintain tight control over temperature and humidity levels. These systems are designed specifically for data center environments, where consistent cooling is necessary to avoid thermal disruptions. High demand from enterprise and hyperscale facilities supports the continued use of precision air conditioning units in both new and retrofitted setups. These units offer accurate environmental control and help avoid energy waste by adjusting to thermal loads. Their operational reliability makes them suitable for data centers requiring uninterrupted performance.

The chillers segment is projected to grow at a robust pace in the coming years, as data centers expand capacity and shift toward scalable cooling infrastructure. These systems provide centralized cooling and are increasingly used in large and modular setups for cost efficiency. Rising construction of high-density facilities is contributing to the accelerated adoption of water-cooled and air-cooled chiller units. As an example, in March 2024, Carrier launched the AquaForce 30XF chiller range, designed specifically to meet the cooling demands of modern data centers. The new series offers high efficiency, low environmental impact, and reliable performance. It helps to lower the overall temperature more effectively in large server rooms where traditional systems face limitations. Their ability to support long operating hours with steady output is encouraging wider deployment.

Size Analysis

The global segmentation, based on size includes, large scale, medium scale, and small scale. The large scale segment accounted for substantial market share in 2024, owing to extensive computing workloads and global cloud infrastructure development. These facilities operate on a 24/7 basis and require advanced thermal systems that can handle high-density server configurations. High investment from technology companies supports this segment’s continued leadership. These facilities often host mission-critical workloads, making precise thermal management essential for long-term operations. The need to meet service-level agreements further supports investment in robust cooling systems.

The small scale segment is projected to grow at a significant pace during the assessment phase, due to the rising demand for edge computing and localized data processing. These setups require compact, energy-efficient cooling systems that can be deployed quickly across urban and remote locations. Growth in smart city infrastructure and IoT applications is supporting this trend. These facilities help reduce network congestion and enhance data speed by operating closer to the user. The demand for decentralized infrastructure across regions is boosting small-scale installations.

Cooling Technique Analysis

The global segmentation, based on cooling technique includes, air cooling, liquid cooling, immersion cooling, evaporative cooling, and free cooling. The air cooling segment was valued at significant share in 2024, due to its low setup cost and ease of maintenance. It is commonly adopted in traditional data centers where moderate density levels are present. Use of raised floor systems and contained airflow solutions further supports efficient cooling across multiple racks. Operators favor air cooling due to its minimal structural changes and easy integration. Its cost-effectiveness continues to make it a popular choice for standard workloads.

The liquid cooling segment is estimated to hold a substantial market share in 2034, as operators look to manage heat in high-performance computing environments. This technique provides higher cooling efficiency and is suitable for dense workloads such as AI, machine learning, and graphics processing. Shift toward sustainable operations and reduced power usage is driving adoption. In October 2024, KAYTUS unveiled its all-liquid cooling solutions at DCWA 2024, designed to meet the high-performance demands of AI-driven data centers. The technology enhances energy efficiency and thermal management for next-gen computing environments. Liquid-based systems reduce energy consumption by transferring heat more effectively than air. These systems also support compact server designs by reducing the need for bulky airflow components.

Service Type Analysis

The global segmentation, based on service type includes, installation & deployment, support & consulting, and maintenance services. The installation and deployment segment is projected to grow during the forecast period, due to the growing number of data center construction projects. These services include equipment setup, integration, and testing to ensure proper thermal control across all operational zones. Demand for expert handling during infrastructure expansion supports this segment’s strength. Professional installation helps minimize errors and ensures systems run at peak efficiency. Rising adoption of advanced equipment requires specialized support during the setup phase.

The maintenance services segment is estimated to witness fastest growth during the forecast period, due to the need for regular system checks and performance optimization. Service providers offer cleaning, inspection, and repair solutions to prevent system downtime. Higher focus on equipment lifespan and thermal efficiency is supporting market growth across this segment. These services help identify early signs of system fatigue and avoid emergency shutdowns. Predictive maintenance tools are also being adopted to lower long-term operational risks.

End User Analysis

The global segmentation, based on end user includes, BFSI, IT and telecom, manufacturing, retail, healthcare, energy and utilities, and others. The IT and telecom segment growth is driven by the high dependency on data storage, cloud applications, and communication services. Large server farms and data hubs operated by technology firms require continuous cooling support to maintain service uptime and prevent operational risks. Thermal stability remains a key requirement in meeting strict uptime targets. Operators in this segment consistently invest in modern cooling to manage dynamic computing loads.

The healthcare segment is estimated to grow at a significant CAGR from 2025-2034, due to increasing reliance on digital health systems, telemedicine platforms, and patient data management. Rising installation of data centers across hospitals and diagnostic centers is creating demand for stable and efficient cooling solutions tailored to sensitive data environments. These centers must operate under strict temperature control to ensure data accuracy and compliance. Expansion of electronic medical records and AI-driven diagnostics is raising the need for reliable thermal systems.

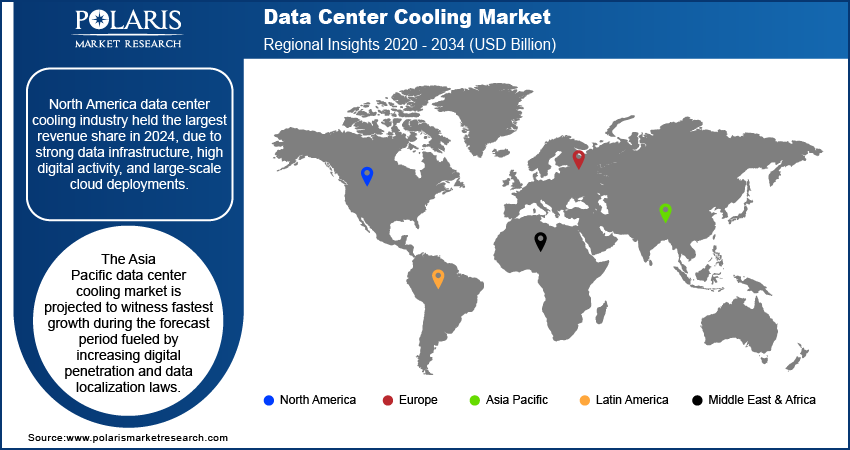

Regional Analysis

North America data center cooling industry held the largest revenue share in 2024, due to strong data infrastructure, high digital activity, and large-scale cloud deployments. The US remained the key contributor with continued expansion in hyperscale campuses and enterprise data hubs. States including Virginia, Texas, and California supported steady demand for scalable cooling systems. For instance, in January 2025, Major tech companies including OpenAI, SoftBank and Oracle announced to invest over USD 500 billion in global data center infrastructure by 2030 to meet rising AI and cloud computing demands. This surge reflects the growing need for high-performance, energy-efficient digital ecosystems. Federal energy programs promote use of efficient thermal solutions to manage power usage. AI workloads and 5G rollout are increasing cooling requirements across core and edge locations. A well-developed supply chain further supports adoption of precision and liquid-based systems.

US Data Center Cooling Market Insight

The US dominated the regional market in 2024. This dominance is attributed to the growing investment in hyperscale, colocation, and enterprise data centers. High energy costs and increasing server densities are pushing operators toward precision cooling and modular solutions. Digital infrastructure strategies are supporting deployment of sustainable systems, aligned with evolving building standards. Regional climate variations require site-specific cooling approaches. Data center growth across Chicago, Phoenix, and Virginia is supported by tax benefits, strong utility access, and available land. Collaborations between technology providers, utilities, and public agencies help streamline adoption of advanced systems while maintaining operational efficiency and environmental compliance.

Asia Pacific Data Center Cooling Market

The Asia Pacific data center cooling market is projected to witness fastest growth during the forecast period fueled by increasing digital penetration and data localization laws. China, India, Japan, and Singapore are expanding data center capacity to meet rising cloud usage and digital service demand. National programs support sustainable infrastructure with emphasis on efficient cooling. Singapore’s green data center framework and Japan’s energy reforms boost the use of liquid and evaporative cooling. Recently, in February 2025, the government of Singapore targets for data centers to achieve a water usage effectiveness of 2.0m3/MWh or less within the next 10 years. Thus, the demand for data center cooling is projected to increase steadily over the coming years. High-density urban centers drive demand for compact and energy-saving systems. Edge deployment for smart cities and industrial applications further supports regional expansion. Cooling solutions with lower power usage are preferred due to rising electricity costs.

Europe Data Center Cooling Market Overview

Europe data center cooling market accounted for significant revenue share in 2024, due to strong regulations and digital infrastructure development. Regional operators follow strict energy efficiency standards, promoting widespread use of advanced cooling systems. Countries including Germany, Netherlands, and Ireland host major data center clusters. For example, in February 2025, DreamHost launched its first international data center in Amsterdam, expanding its global footprint to better serve customers across Europe with enhanced performance and data sovereignty. Moreover, the EU’s Green Deal and new server eco-design rules promote deployment of liquid and free cooling solutions. Operators are modernizing existing sites to meet environmental targets. Cold regional climates support partial use of natural cooling. Availability of renewable energy and improved connectivity further enhances infrastructure resilience and cooling adoption.

Key Players & Competitive Analysis Report

The data center cooling industry is highly competition, due to increasing demand for thermal efficiency, regulatory compliance, and scalable infrastructure. Leading providers are offering modular, energy-efficient cooling systems that reduce power usage and support high-density environments. Market participants are focusing on product innovation, regional capacity expansion, and customized solutions suited for hyperscale and edge deployments. Partnerships with data center operators and technology integrators support service coverage and customer retention. Emphasis on reliability, real-time monitoring, and integration with facility management platforms contributes to strong positioning across global and regional markets.

Key companies in the industry include Vertiv Holdings Co., Schneider Electric SE, STULZ GmbH, Rittal GmbH & Co. KG, Mitsubishi Electric Corporation, Eaton Corporation plc, Daikin Industries Ltd., Trane Technologies plc, Airedale International Air Conditioning Ltd., Huawei Technologies Co. Ltd., Nortek Air Solutions, and Johnson Controls International plc.

Key Players

- Vertiv Holdings Co.

- Schneider Electric SE

- STULZ GmbH

- Rittal GmbH & Co. KG

- Mitsubishi Electric Corporation

- Eaton Corporation plc

- Daikin Industries Ltd.

- Trane Technologies plc

- Airedale International Air Conditioning Ltd.

- Huawei Technologies Co. Ltd.

- Nortek Air Solutions

- Johnson Controls International plc

Industry Developments

June 2025: Shell introduced its latest Direct Liquid Cooling (DLC) fluid designed to enhance thermal management in high-performance data centers. The solution supports energy-efficient operations and aligns with sustainability goals for advanced digital infrastructure.

May 2025: Chemours and DataVolt partnered to advance liquid cooling technologies for AI-driven data centers. The collaboration aims to enhance energy efficiency and enable scalable, future-ready infrastructure.

April 2025: LG launched a comprehensive end-to-end cooling solution tailored for high-capacity data centers, addressing rising thermal management demands. The system enhances efficiency and reliability across large-scale digital infrastructure.

Data Center Cooling Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Air Conditioners

- Precision Air Conditioners

- Chillers

- Air Handling Units

- Others

By Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Scale

- Medium Scale

- Small Scale

By Cooling Technique Outlook (Revenue, USD Billion, 2020–2034)

- Air cooling

- Liquid cooling

- Immersion cooling

- Evaporative cooling

- Free cooling

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- Installation & Deployment

- Support & Consulting

- Maintenance Services

By End User Type Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- IT and Telecom

- Manufacturing

- Retail

- Healthcare

- Energy and Utilities

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Data Center Cooling Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 21.18 Billion |

|

Market Size in 2025 |

USD 24.45 Billion |

|

Revenue Forecast by 2034 |

USD 91.68 Billion |

|

CAGR |

15.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 21.18 billion in 2024 and is projected to grow to USD 91.68 billion by 2034.

The global market is projected to register a CAGR of 15.8% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Vertiv Holdings Co., Schneider Electric SE, STULZ GmbH, Rittal GmbH & Co. KG, Mitsubishi Electric Corporation, Eaton Corporation plc, Daikin Industries Ltd., Trane Technologies plc, Airedale International Air Conditioning Ltd., Huawei Technologies Co. Ltd., Nortek Air Solutions, and Johnson Controls International plc.

The precision air conditioners segment dominated the market in 2024

The maintenance services segment is estimated to witness fastest growth during the forecast period.