Food Pathogen Testing Market Size, Share, Trends, & Industry Analysis Report

By Type (Salmonella and E.Coli), By Food Test, By Technology, By Pathogen Type, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5869

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

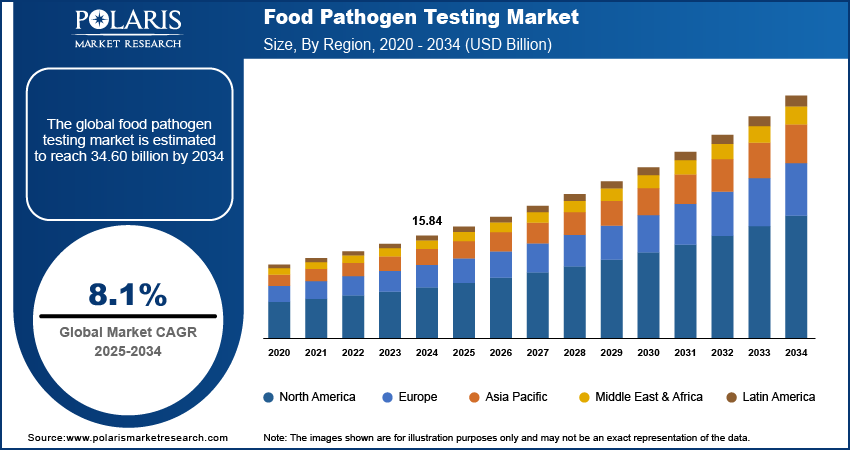

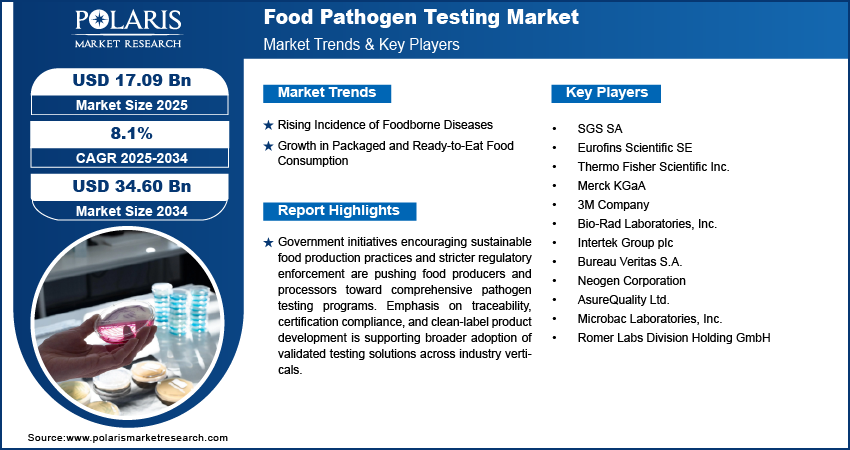

The global food pathogen testing market size was valued at USD 15.84 billion in 2024, growing at a CAGR of 8.1% during 2025–2034. Increasing foodborne disease cases and higher consumption of packaged and ready-to-eat foods are driving the need for robust pathogen testing solutions.

Food pathogen testing is a diagnostic process applied to detect harmful microorganisms in food products across categories such as dairy food, meat, seafood, bakery products, packaged foods, and beverages. It involves microbiological, molecular, and immunological techniques to identify pathogens including salmonella, listeria monocytogenes, E. coli, and campylobacter. This is integrated into food safety testing protocols to ensure product quality, verify regulatory compliance, and minimize contamination risks throughout production and distribution stages.

Stricter global food safety standards and heightened consumer awareness are increasing the demand for efficient testing systems. Food manufacturers are adopting rapid detection methods with automated workflows to reduce turnaround time and limit recall exposure. Advancements in multiplex assays, sensor technologies, and laboratory automation are improving test reliability and throughput. Stakeholders are upgrading quality assurance infrastructure to meet with certification frameworks such as HACCP and ISO 22000, food pathogen testing remains an essential component of risk management and product integrity in modern food supply chains.

To Understand More About this Research: Request a Free Sample Report

Food pathogen testing is increasingly being adopted across food processing, packaging, and distribution facilities to maintain hygiene, support quality assurance, and comply with evolving food safety regulations. Its use in dairy plants, meat processing lines, ready meals units, and beverage bottling systems helps detect microbial contamination at critical control points, reducing the risk of outbreaks and recall-related disruptions. Integration of automated detection platforms in production environments enables consistent monitoring and faster response times, helping manufacturers maintain throughput and meet certification requirements under frameworks such as FSMA and ISO 22000.

The growing focus on regulatory frameworks and traceability across the food industry is influencing technology investments in microbial testing infrastructure. For instance, in October 2024, HaystackAnalytics launched a new diagnostic test that detects bacterial infections, fungal pathogens, and respiratory RNA viruses in a single test. It also aims to improve early and accurate disease detection. Also, rapid test kits, real-time PCR systems, and lab-on-chip platforms are growing steadily due to companies focus on faster, more accurate methods for detecting pathogens. Procurement teams are choosing testing solutions that minimize false positives, support data traceability, and reduce operational delays. These efforts help to attain broader sustainability and compliance goals while contributing to long-term risk reduction and cost efficiency.

Industry Dynamics

Rising Incidence of Foodborne Diseases

Foodborne illnesses have emerged as a growing public health concern across both developed and developing regions. Contaminated food products remain a major source of gastrointestinal infections, often caused by pathogens such as salmonella, listeria monocytogenes, escherichia coli, and campylobacter. According to the World Health Organization (WHO), foodborne diseases affect 600 million people globally each year, placing greater responsibility on producers to verify safety throughout the supply chain. These trends are driving regulatory agencies and food safety authorities to impose stricter microbiological testing standards for high-risk food categories such as meat, poultry, seafood, dairy, and fresh produce.

Food manufacturers are strengthening their internal quality control protocols to reduce contamination risks and meet compliance requirements. The rising frequency of contamination-related recalls, legal penalties, and reputational damage is strengthening the need for consistent and precise pathogen detection systems. Laboratories and production facilities are increasingly integrating advanced diagnostic tools that offer rapid detection and quantifiable results. The emphasis on early identification and prevention of microbial hazards is expanding the adoption of food pathogen testing solutions across primary production, processing, and packaging operations.

Growth in Packaged and Ready-to-Eat Food Consumption

The global shift toward urban living, busy work schedules, and changing dietary preferences significantly increasing the demand for packaged and ready-to-eat (RTE) foods. According to the 2024 FERN report, ready-made meals currently account for around 17% of the total calorie intake in the EU. Consumption is rising quickly, with people in Italy, Germany, and Spain eating 40% to 60% more ready meals over the past 15 years. These products are convenient but more prone to microbial contamination due to extended shelf life, complex supply chains, and multiple points of handling. With the rising volume of RTE foods across supermarket shelves, vending outlets, and food delivery platforms, food safety stakeholders are compelled to implement more frequent and rigorous pathogen testing to protect consumers and ensure brand integrity.

Producers of packaged and RTE foods are adopting standardized pathogen screening protocols at every critical control point, from raw material intake to final packaging. Maintaining microbial stability throughout storage and distribution is essential to prevent product recalls and retain consumer confidence. The increasing reliance on cold chain logistics and multi-region distribution adds further complexity to contamination control. As a result, companies are investing in advanced testing technologies that deliver high sensitivity, shorter detection times, and compatibility with high-throughput production environments. This market dynamic is driving continuous demand for scalable and reliable pathogen testing frameworks across the global food industry.

Segmental Insights

Type Analysis

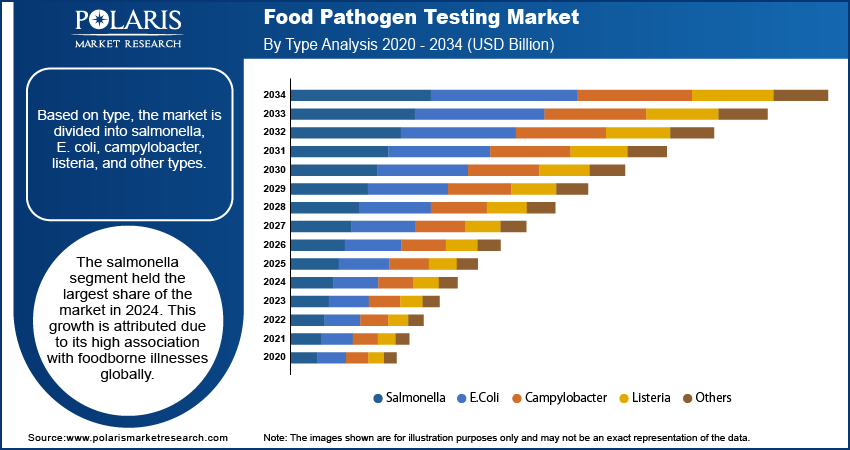

The global segmentation, based on type includes, salmonella, E.Coli, campylobacter, listeria, and other type. The salmonella segment held the largest share of the market. This growth is attributed due to its high association with foodborne illnesses globally. It is frequently detected in meat, poultry, eggs, and dairy, leading to strict regulatory oversight. According to the USDA, global chicken meat production rose by 2% in 2025, reaching 105.8 million tons, driven by increased output from major producers such as the US, the European Union, Brazil, Turkey, and China. Food manufacturers prioritize salmonella testing to prevent large-scale recalls and ensure public safety. With growing global trade and stringent export regulations, the adoption of PCR and immunoassay-based kits is rising. Continued prevalence in high-risk food categories and regulatory pressure are expected to sustain its dominance over the forecast period.

The listeria segment is projected to grow at a robust pace in the coming years, due to its ability to thrive in cold environments and its severe impact on health in vulnerable groups. Its presence in refrigerated and ready-to-eat foods, such as soft cheeses and deli meats led to increased testing. Rapid detection methods, including real-time PCR and DNA-based assays are being adopted to meet compliance with food safety regulations. As manufacturers prioritize zero-tolerance policies for listeria, this segment is witnessing accelerated growth across cold-chain dependent product categories.

Food Test Analysis

The global segmentation, based on food test includes, meat & poultry, fish & seafood, dairy, processed food, fruits & vegetables, cereals & grains, and other food test. The meat and poultry segment dominated the market share in 2024, due to high contamination risks from pathogens such as salmonella and E. coli. Regulatory bodies in regions such as the US and EU mandate routine testing in meat-processing facilities, driving demand for advanced detection solutions. Producers are investing in rapid diagnostics to ensure quality and avoid shipment delays. The segment’s large-scale production volumes, complex supply chains, and public health sensitivity support its continued market leadership.

The dairy segment is projected to grow at a significant pace during the assessment phase, driven by rising consumption of pasteurized and minimally processed dairy products. Products such as milk, yogurt, and cheese are prone to contamination by pathogens such as listeria and salmonella. According to IFCN, global milk production grew by 2.2% in 2023, showing recovery after slow growth in 2022. India remained the top producer, with a 5% increase, close to its 10-year average of 5.2%. Manufacturers are enhancing their testing capabilities using molecular diagnostics to comply with strict hygiene regulations. Demand for clean-label and high-quality dairy offerings further accelerates adoption of reliable pathogen screening solutions in export-focused markets.

Technology Analysis

The global segmentation, based on technology includes, traditional and rapid. The rapid segment was valued at substantial share in 2024, as food producers increasingly require faster and more efficient pathogen detection. These methods, including PCR and immunoassays, enable early identification, minimize downtime, and reduce risks of product recalls. Rapid solutions integrate easily into automated systems, making them suitable for high-throughput food manufacturing environments. Their enhanced accuracy and compatibility with digital reporting systems further support broad adoption across global facilities.

The traditional segment is estimated to hold a substantial industry share in 2034, particularly in developing regions where cost-effectiveness and consumer familiarity drive adoption. Techniques such as culture-based identification are widely used in small and medium-sized enterprises due to their cost-effectiveness and regulatory acceptance. Government support for building food safety infrastructure and conducting laboratory-based testing programs contributes to continued demand in regions with limited access to advanced testing platforms.

Pathogen Type Analysis

The global segmentation, based on pathogen type includes, bacteria, viruses, protozoa, and fungi. The bacteria segment is projected to grow at a significant CAGR during the forecast period, as it is responsible for the majority of foodborne illnesses. Common bacterial contaminants include salmonella, listeria, and E. coli, all requiring frequent testing in food production. Their widespread presence across different food types makes bacterial detection a routine requirement in compliance with global food safety standards. Bacterial testing dominates due to its relevance, regulatory focus, and technological advancement in detection methods.

The viruses segment is estimated to hold a significant market share in 2034, due to heightened focus on viral contamination risks such as norovirus and hepatitis A. Rising awareness of their impact on public health in ready-to-eat and frozen food items is pushing food companies to expand testing. Improved molecular diagnostic tools are enhancing the detection of viral pathogens, even at low concentrations. This segment is growing rapidly as food supply chains become more complex and require broader microbial risk coverage.

End User Analysis

The global segmentation, based on end user includes, food manufacturers, food retailers, quality control laboratories, and government agencies. The food manufacturers segment is witnessing growth as it is directly responsible for product quality and safety. Routine pathogen testing is integrated into production workflows to comply with HACCP, ISO 22000, and regional food laws. Investment in high-throughput, rapid testing systems enables early contamination detection and prevention of costly recalls. Their central role in food safety and traceability drives their dominance in end-user adoption.

The quality control laboratories segment is estimated to grow at a significant CAGR from 2025-2034, due to increased outsourcing of food safety testing. Small and mid-sized food businesses rely on third-party labs to meet compliance without investing in in-house infrastructure. Laboratories are adopting rapid and automated testing platforms to enhance service capacity and turnaround. Rising demand for third-party certifications and export compliance further boosts their role in the global food safety ecosystem.

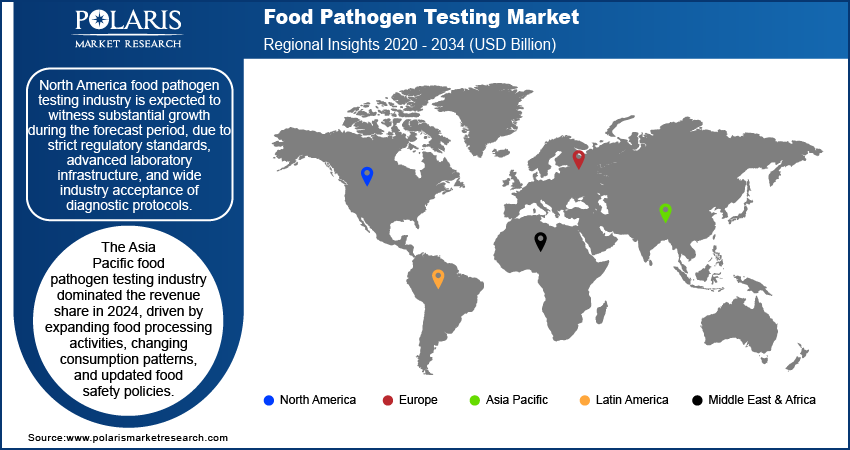

Regional Analysis

North America food pathogen testing industry is expected to witness substantial growth during the forecast period, due to strict regulatory standards, advanced laboratory infrastructure, and wide industry acceptance of diagnostic protocols. The region’s food manufacturers are adopting pathogen testing to meet compliance and avoid product recalls. Testing is conducted frequently across meat, poultry, dairy, and packaged foods. Agencies such as the FDA and USDA enforce safety checks at different stages of production. Increasing focus on product transparency and consumer safety is driving consistent use of rapid diagnostic tools. Investments in automation, traceability, and lab certifications are supporting food companies in maintaining quality and minimizing microbial risks.

US Food Pathogen Testing Market Insight

The US food pathogen testing market is driven by the strong food safety framework coupled with the strict laws such as Food Safety Modernization Act (FSMA) across the country. According to the USDA, food recalls rose by 20% in 2023, increasing from 454 to 547 cases, with Class I recalls seeing the highest surge. Key causes included allergen contamination (40%), bacterial contamination (21.1%), and foreign objects (11.6%). Thus, companies are extensively trying to improve testing protocols that drives the demand for the food pathogen testing in this region. Food processors are adopting rapid test kits and molecular detection tools across high-risk categories. The country also benefits from strong infrastructure, skilled workforce, and accredited laboratories. Increasing consumer demand for food safety and shelf-stable products is influencing companies to enhance quality controls. This industry continues to grow steadily through industry modernization and strict enforcement measures.

Asia Pacific Food Pathogen Testing Market Trend

The Asia Pacific food pathogen testing industry dominated the revenue share in 2024, driven by expanding food processing activities, changing consumption patterns, and updated food safety policies. Countries such as China, India, and Japan are increasing investment in food testing infrastructure to meet domestic and international standards. According to India’s Ministry of Food Processing Industries, 100 new NABL-accredited food testing laboratories are planned to be established across the country by 2026 to strengthen food safety and quality standards. Rapid urbanization and rising demand for packaged foods are creating a need for reliable contamination detection. Food exporters are also upgrading testing facilities to meet import regulations. Adoption of compact diagnostic tools is increasing in metropolitan food production zones. As regulatory awareness grows and production scales expand, the region is becoming a key focus for market participants.

Europe Food Pathogen Testing Market Overview

Europe food pathogen testing market growth is fueled by its strict safety regulations, high food quality standards, and regular industry audits. Countries such as Germany, France, and Italy conduct frequent microbiological testing across meat, dairy, and fresh produce categories. As per Eurostat, EU poultry meat production grew by 2.3% in 2023 to 13.3 million tonnes, returning to 2020 levels. Poland was the top producer with 2.7 million tonnes, followed by Spain, Germany, and France. Italy’s output rose by 10%, reaching 1.3 million tonnes. Food processors in the region follow EU safety directives that mandate pathogen detection before products reach retail distribution. The Energy Efficiency Act and sustainability-focused production standards are driving the use of automated testing systems. Adoption of rapid diagnostic tools is increasing across centralized laboratories and in-house testing units, improving contamination control and supply chain integrity.

Key Players & Competitive Analysis Report

The food pathogen testing industry is moderately consolidated, featuring global diagnostic firms, assay developers, and contract laboratories offering solutions across multiple food sectors. Competition focuses on test accuracy, processing speed, compliance, and integration with modern technologies. Companies are enhancing portfolios with rapid test kits, PCR tools, and multiplex platforms to meet food safety standards across categories such as meat, dairy, and seafood. Investments in AI-driven analytics, digital traceability, and automation-based processing support product differentiation. Strategic alliances, partnerships, and lab accreditations are improving market reach, while ISO 17025 and HACCP compliance remains a key priority. Localized testing infrastructure and region-specific panels are shaping procurement decisions.

Key companies in the industry include SGS SA, Eurofins Scientific SE, Thermo Fisher Scientific Inc., Merck KGaA, 3M Company, Bio-Rad Laboratories, Inc., Intertek Group plc, Bureau Veritas S.A., Neogen Corporation, AsureQuality Ltd., Microbac Laboratories, Inc., and Romer Labs Division Holding GmbH.

Key Players

- SGS SA

- Eurofins Scientific SE

- Thermo Fisher Scientific Inc.

- Merck KGaA

- 3M Company

- Bio-Rad Laboratories, Inc.

- Intertek Group plc

- Bureau Veritas S.A.

- Neogen Corporation

- AsureQuality Ltd.

- Microbac Laboratories, Inc.

- Romer Labs Division Holding GmbH

Industry Developments

February 2025: bioMérieux launched GENE-UP TYPER, a molecular solution that helps food industries quickly and accurately identify Listeria strains. This new tool aims to enhance food safety and improve contamination source tracking.

May 2024: NOMADX Holdings launched an early access program for its handheld food pathogen detection platform, designed to deliver fast and accurate results directly at food production sites, enhancing food safety and quality control.

July 2023: Spectacular Labs announced to launch its automated pathogen testing system at IAFP 2023, aiming to speed up and simplify food safety testing processes.

Food Pathogen Testing Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Salmonella

- E.Coli

- Campylobacter

- Listeria

- Other Type

By Food Test Outlook (Revenue, USD Billion, 2020–2034)

- Meat & Poultry

- Fish & Seafood

- Dairy

- Processed Food

- Fruits & Vegetables

- Cereals & Grains

- Other Food Test

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Traditional

- Quantitative Culture

- Qualitative Culture

- Rapid

- Convenience-based

- PCR

- Immunoassay

- Other Molecular based test

By Pathogen Type Outlook (Revenue, USD Billion, 2020–2034)

- Bacteria

- Viruses

- Protozoa

- Fungi

By End User Type Outlook (Revenue, USD Billion, 2020–2034)

- Food Manufacturers

- Food Retailers

- Quality Control Laboratories

- Government Agencies

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Food Pathogen Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 15.84 Billion |

|

Market Size in 2025 |

USD 17.09 Billion |

|

Revenue Forecast by 2034 |

USD 34.60 Billion |

|

CAGR |

8.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 15.84 billion in 2024 and is projected to grow to USD 34.60 billion by 2034.

The global market is projected to register a CAGR of 8.1% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are SGS SA, Eurofins Scientific SE, Thermo Fisher Scientific Inc., Merck KGaA, 3M Company, Bio-Rad Laboratories, Inc., Intertek Group plc, Bureau Veritas S.A., Neogen Corporation, AsureQuality Ltd., Microbac Laboratories, Inc., and Romer Labs Division Holding GmbH.

The salmonella segment dominated the market share in 2024.

The dairy segment is projected to grow at a significant pace during the assessment phase.