Operational Technology Market Size, Share, Trends, Industry Analysis Report

: By Offering (Hardware, Software, and Services), Connectivity, Deployment Type, Enterprise Size, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5608

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

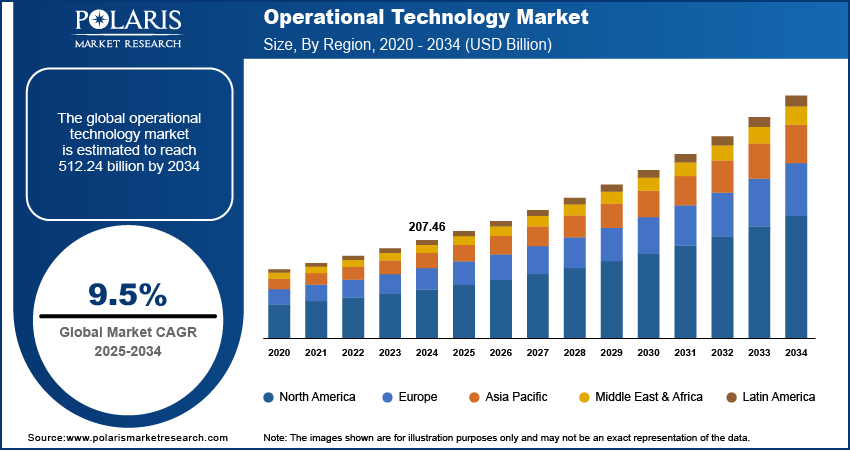

The global operational technology market size was valued at USD 207.46 billion in 2024, exhibiting a CAGR of 9.5% during 2025–2034. The market is driven by Industry 4.0 investments, increased digitalization, rising cybersecurity needs, and growing renewable energy projects requiring advanced OT systems.

Key Insights

- Hardware dominates the market, driven by demand for advanced sensors, PLCs, and automation equipment across manufacturing, energy, and utilities.

- The wired connectivity segment led in 2024 due to its reliability, low latency, and secure data transmission, making it the preferred choice for industries such as oil and gas, manufacturing, and utilities.

- Asia Pacific leads regional growth due to rapid industrialization and government-backed smart manufacturing initiatives, with China as a key driver.

- North America remains a major market player, supported by advanced automation adoption, digital transformation, and strong cybersecurity focus.

Market Dynamics

- Industry 4.0 investments boost demand for scalable OT systems with sensors, robotics, and analytics focused on cybersecurity, but integrating legacy systems slows adoption.

- Rising cyberattacks drive heavy investment in OT security, yet evolving threats still challenge existing protections.

- Renewable energy projects require strong OT for grid integration and maintenance, but intermittent sources and grid complexity create challenges.

- Wireless connectivity grows fast for its flexibility and cost, while wired networks dominate critical low-latency uses; security and reliability concerns limit wireless adoption.

Market Statistics

2024 Market Size: USD 207.46 billion

2034 Projected Market Size: USD 512.24 billion

CAGR (2025–2034): 9.5%

Asia Pacific: Largest market in 2024

AI Impact on Operational Technology Market

- AI enables real-time data analysis in OT systems, improving predictive maintenance, fault detection, and process optimization.

- Integration of AI enhances automation and decision-making, reducing human intervention in complex industrial environments.

- AI supports energy efficiency by optimizing resource allocation and reducing downtime in manufacturing and utilities.

- AI-powered cybersecurity tools strengthen OT system defenses by identifying anomalies and responding to threats faster.

- Combining AI with edge computing accelerates processing at the source, improving responsiveness in time-sensitive operations.

To Understand More About this Research: Request a Free Sample Report

Operational technology (OT) refers to the hardware and software systems used to monitor, control, and manage physical devices, processes, and infrastructure in industrial and other physical environments. OT encompasses systems such as industrial control systems (ICS) security, supervisory control and data acquisition (SCADA) systems, distributed control systems (DCS), and programmable logic controllers (PLCs). These systems interact directly with physical equipment such as ball valves, pumps, motors, and IoT sensors to regulate processes and collect data. They are widely used in industries such as manufacturing, energy, transportation, utilities, and healthcare. OT is essential for automating production lines, managing power grids, controlling water treatment facilities, and optimizing building management systems.

The global surge in Industry 4.0 investment is propelling the operational technology market growth. Companies are heavily investing in Industry 4.0, which relies heavily on sensors, robotics, industrial control systems, and real-time data analytics. This shift requires robust and scalable operational technology to integrate physical equipment, such as sensors and robotics, with digital systems. Additionally, Industry 4.0 emphasizes cybersecurity and interoperability, pushing businesses to upgrade their OT systems to meet higher standards of efficiency and safety.

The operational technology market demand is driven by rising digitalization across industries. Digital transformation pushes factories to adopt smart manufacturing techniques, increasing the need for OT solutions that bridge the gap between IT systems and industrial equipment. Cloud computing and edge analytics further drive OT demand as businesses seek faster, more reliable ways to process operational data at the source. The growing integration of artificial intelligence and machine learning into industrial production systems also relies on OT to execute real-time adjustments, boosting productivity and reducing downtime. Hence, as digitalization in industries increases, the demand for operational technology also continues to rise.

Market Dynamics

Rising Incidence of Cyber Attacks Globally

Increasing cyberattacks globally are pushing companies to invest in advanced OT solutions to detect, prevent, and respond to threats in real time. Cyberattacks disrupt production, cause financial losses, and pose safety risks, pushing organizations to adopt OT security measures such as network segmentation, intrusion detection systems, and secure remote access. Regulatory requirements and industry standards are further compelling companies to upgrade their OT systems to meet compliance mandates. Thus, with cyber threats growing more sophisticated, industries are recognizing that robust OT security is no longer optional but a necessity to ensure operational continuity and protect critical assets, leading to high demand. For instance, according to data published by the Center for Strategic and International Studies, Russian cyberattacks on Ukraine surged by nearly 70% in 2024, with 4,315 incidents targeting critical infrastructure, including government services, the energy sector, and defense-related entities. This sharp increase in targeted cyber incidents highlights the escalating risks faced by critical infrastructure worldwide, reinforcing the urgent need for advanced OT cybersecurity measures to safeguard national assets, maintain operational resilience, and counter evolving geopolitical cyber threats.

Increasing Investment in Renewable Energy Generation

Renewable energy facilities rely heavily on real-time data monitoring, predictive maintenance, and grid-balancing technologies, all of which depend on robust OT solutions. Smart inverters, energy storage systems, and distributed energy resources (DERs) need OT systems to ensure seamless integration with the grid while maintaining stability and efficiency. The intermittent nature of renewables also forces grid operators to deploy OT-driven automation for load forecasting, frequency regulation, and fault detection. Additionally, as renewable projects scale up, cybersecurity becomes critical, driving investments in secure OT infrastructure to protect against cyber threats. For instance, as per the data published by the India Brand Equity Foundation, India is set to invest over USD 360 billion in renewable energy and infrastructure by 2030. Governments and energy companies further push OT adoption by implementing digital twins and AI-driven analytics to maximize energy output and reduce downtime. Therefore, as investment toward cleaner energy increases, operational technology becomes crucial for maintaining reliable, efficient, and resilient renewable power systems.

Operational Technology Market Segment Insights

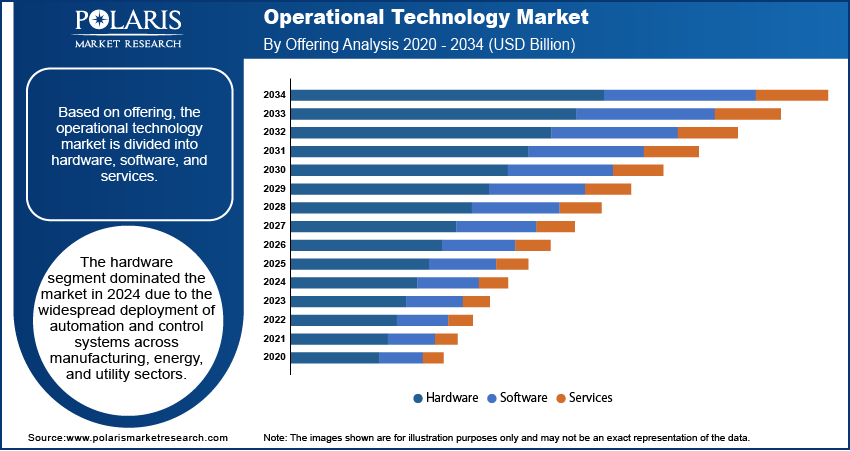

Operational Technology Market Evaluation by Offering

Based on offering, the market is divided into hardware, software, and services. The hardware segment dominated the market in 2024 due to the widespread deployment of automation and control systems across manufacturing, energy, and utility sectors. Industries are prioritizing upgrading their physical infrastructure with advanced sensors, programmable logic controllers (PLCs), and human-machine interfaces (HMIs) to enhance operational efficiency, reduce downtime, and meet safety compliance standards. The growing demand for edge devices and industrial control systems, which form the backbone of real-time data acquisition and process control, has further strengthened the dominance of the hardware segment. Additionally, increased investments in industrial modernization, especially in emerging economies, have supported segment expansion by encouraging the replacement of traditional systems with more intelligent and connected devices.

The software segment is expected to grow at a robust pace in the coming years. Companies are increasingly adopting integrated software platforms for predictive maintenance, real-time analytics, and centralized asset management. The shift toward digital transformation, supported by the Industrial Internet of Things (IIoT) and artificial intelligence, has created a growing need for scalable, secure, and interoperable software solutions. Moreover, the rise of cybersecurity threats targeting industrial environments has prompted greater investment in security-focused software, contributing to segmental growth.

Operational Technology Market Insight by Connectivity

In terms of connectivity, the market is segregated into wired and wireless. The wired segment accounted for a major market share in 2024 due to its reliability, low latency, and robust performance in mission-critical industrial environments. Industries such as oil and gas, manufacturing, and utilities favor wired networks for their ability to ensure stable and secure data transmission across harsh areas. The proven effectiveness of wired solutions has led many enterprises to retain or expand their existing network setups rather than shift immediately to newer alternatives.

The wireless segment is projected to grow at the fastest pace during the forecast period owing to its flexibility, scalability, and cost-effectiveness in supporting digital transformation initiatives. Wireless technology solutions enable seamless communication between decentralized assets and support applications such as predictive maintenance, autonomous vehicles, and remote diagnostics. Furthermore, advancements in wireless security protocols and the ability to integrate wireless systems with edge computing platforms have increased confidence in their deployment across critical operations. The push toward smart factories and connected infrastructure has accelerated the demand for wireless networks, contributing to segmental growth.

Regional Analysis

By region, the operational technology market report provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for a major market share in 2024 due to rapid industrialization, government-led infrastructure initiatives, and rising investments in smart manufacturing across major economies. China led the regional market due to its aggressive push toward factory automation, digital infrastructure development, and the integration of Industrial Internet of Things (IIoT) technologies. The country's focus on initiatives like “Made in China 2025” and its support for high-tech industries has stimulated demand for control systems, industrial robotics, and intelligent monitoring solutions. Additionally, strong growth in sectors such as automotive, electronics, and energy has encouraged both domestic and international companies to modernize operations, further contributing to the region’s market dominance.

North America is projected to hold a dominant share of the market in the coming years, owing to the rapid adoption of advanced industrial automation, strong investments in smart manufacturing, and the presence of key market players such as Rockwell Automation, Honeywell, and others. The US is expected to lead the region due to its aggressive digital transformation strategies across sectors such as oil & gas, utilities, and manufacturing. Government initiatives such as the National Institute of Standards and Technology (NIST) frameworks and increasing emphasis on cybersecurity are anticipated to further fuel the market’s expansion.

Operational Technology Market – Key Players and Competitive Insights

The market landscape is rapidly evolving, driven by strategic mergers, acquisitions, partnerships, collaborations, and an expanding product portfolio. Major companies are leveraging these strategies to enhance their technological capabilities and market presence. Companies such as Siemens and ABB have acquired smaller, innovative firms to integrate advanced technologies into their existing OT solutions, boosting their offerings in industrial automation and smart infrastructure. Partnerships and collaborations further amplify competitive advantages. These alliances facilitate the development of comprehensive ecosystems that cater to diverse industry needs, from manufacturing to utilities. Moreover, expanding product portfolios by key companies is driving the OT market. Companies such as Rockwell Automation and Schneider Electric continuously innovate, introducing advanced products like predictive maintenance tools and cybersecurity solutions tailored for OT environments. This diversification not only addresses current market demands but also anticipates future challenges, ensuring sustained growth.

The operational technology market is fragmented, with the presence of numerous global and regional market players. Major players in the market are ABB; Emerson Electric Co.; General Electric; Hitachi, Ltd.; Honeywell International Inc.; IBM Corporation; Oracle; Rockwell Automation; Schneider Electric; and Siemens.

Rockwell Automation is a global company in industrial automation and operational technology, driving innovation in smart manufacturing and digital transformation. The company’s approach to operational technology emphasizes the seamless integration of IT and OT systems, enabling manufacturers to optimize processes, enhance productivity, and achieve sustainability goals. Rockwell Automation leverages advanced technologies such as the Industrial Internet of Things (IIoT), digital twins, and edge computing to transform manufacturing operations. Its IIoT solutions enable real-time data collection and analysis, improving predictive maintenance, process optimization, and asset utilization. Digital twin technology allows organizations to simulate and optimize operations in virtual environments, reducing downtime and operational risks. Additionally, edge computing ensures rapid data processing at the source, enhancing responsiveness in critical applications like automated quality inspections.

IBM Corporation, a global leader in technology and innovation, plays a crucial role in advancing OT cybersecurity for critical infrastructure industries. The company's OT cybersecurity solutions address vulnerabilities arising from interconnected devices, outdated architectures, and insufficient security protocols. IBM’s approach emphasizes real-time threat detection, continuous monitoring, and rapid incident response powered by artificial intelligence and machine learning technologies. Its operational technology cybersecurity (OTCY) program builds on the Purdue enterprise reference model, a widely adopted framework in industrial automation. This alignment allows IBM to design tailored solutions that secure OT environments while maintaining operational efficiency.

List of Key Companies

- ABB

- Emerson Electric Co.

- General Electric

- Hitachi, Ltd.

- Honeywell International Inc.

- IBM Corporation

- OMRON Corporation

- Rockwell Automation

- Schneider Electric

- Siemens

Operational Technology Industry Developments

November 2022: Honeywell launched operational technology (OT) cybersecurity solutions, including an Advanced Monitoring and Incident Response (AMIR) dashboard and updated Cyber App Control. These tools enhance 24/7 threat detection and help protect industrial control systems (ICS) from risks to availability, reliability, and safety.

August 2023: Schneider Electric launched Managed Security Services (MSS) for operational technology (OT) environments, addressing rising cyber risks.

Operational Technology Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Connectivity Outlook (Revenue, USD Billion, 2020–2034)

- Wired

- Wireless

By Deployment Type Outlook (Revenue, USD Billion, 2020–2034)

- Cloud

- On-Premises

By Enterprise Size Outlook (Revenue, USD Billion, 2020–2034)

- SMEs

- Large Enterprises

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 207.46 billion |

|

Market Size Value in 2025 |

USD 226.71 billion |

|

Revenue Forecast in 2034 |

USD 512.24 billion |

|

CAGR |

9.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 207.46 billion in 2024 and is projected to grow to USD 512.24 billion by 2034.

The global market is projected to grow at a CAGR of 9.5% from 2025 to 2034.

Asia Pacific had the largest share of the global market in 2024.

Some of the key players in the market are ABB; Emerson Electric Co.; General Electric; Hitachi, Ltd.; Honeywell International Inc.; IBM Corporation; OMRON Corporation; Rockwell Automation; Schneider Electric; and Siemens.

The hardware segment dominated the market in 2024.

The wireless segment is expected to grow at the fastest pace in the coming years.